Dubai’s VARA releases Virtual Assets and Related Activities Regulations 2023

With the founding of Virtual Assets Regulatory Agency (VARA), Dubai took a huge leap ahead of other countries by introducing a regulatory framework that not only put the Emirate in a leading position but also promotes effective governance, regulation, and licensing of service providers for virtual assets such as cryptocurrencies and Non-Fungible Tokens. VARA will ensure security and confidence of both investors and users in the virtual asset industry in Dubai with the exception of Dubai International Financial Center (DIFC).

VARA was founded on February 28, 2022, pursuant to Law No. (4) of 2022 in Dubai issued by its ruler Sheikh Mohammed Bin Rashid Al Maktoum in coordination with Dubai World Trade Center Authority (DWTCA), Securities and Commodities Authority (SCA) and Central Bank of the United Arab Emirates (CBUAE).

Regulations

The following Virtual Asset Activities are governed by VARA’s regulations:

- Advisory services

- Broker-Dealer services

- Custody services

- Exchange services

- Lending and Borrowing services

- Payments and Remittances services

- Management and Investment services

Each of the Virtual Asset Activities regulated by VARA has a rulebook that VARA license holders must comply with in line with a set of compulsory rulebooks:

- Virtual Assets and Related Activities Regulations 2023

- Company Rulebook

- Compliance and Risk Management Rulebook

- echnology and Information Rulebook

- Market Conduct Rulebook

- VA Issuance Rulebook

Licensing Process Overview

Applicants for VARA licenses can apply for Minimum Viable Product (MVP) or Full Market Product (FMP) licenses depending on their operating requirement or as mandated by VARA. Applicants are divided into 3 categories:

Category A - MVP applicants that are currently in the process of securing a VARA License:

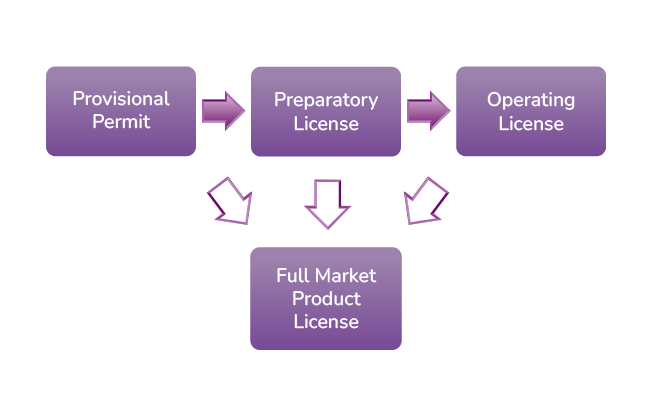

The MVP License is a 3-stage process starting with a (1) Provisional Permit; graduating to a (2) Preparatory License and concluding with an (3) Operating License.

Applicants that are already in the MVP process will be advised by VARA to either continue within the MVP licensing process and/or be transitioned to the FMP licensing process.

Category B - Existing local (legacy) VASPs that are required to come under VARA purview:

All VASPs operating in Dubai except DIFC may apply for any of the following:

- FMP Regulated License

- FMP Registration – VASPs operating with unregulated activities that may intersect with VARA regulated activities may not require full regulatory supervision but must still register in order to freely operate within the domestic market. VARA may require full regulatory supervision at any time in the future at VARAs sole and absolute discretion.

- No Objection Certificate – VASPs operating with unregulated activities.

Category C – New applicants seeking a VARA License in order to offer VA services in Dubai after February 7, 2023:

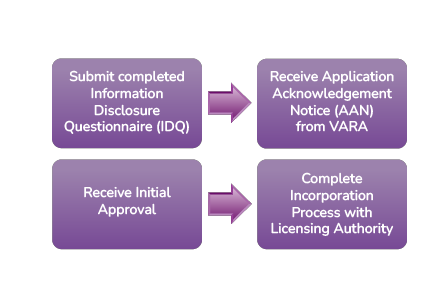

All applicants can begin the application process through their licensing authority or directly through VARA:

Mandatory registration for large proprietary traders

Any Entity in the Emirate that actively invests its own portfolio in Virtual Assets at or above USD 250,000,000 equivalent value of Virtual Assets during any rolling thirty [30] calendar days period, must register with VARA, in accordance with the registration process prescribed by VARA from time to time, prior to investing at, or in no event later than three [3] Working Days of having invested, such volume.

Fines and Penalties

Violation of Regulations

Violation of the Regulations, or rules in the Compliance and Risk Management Rulebook, Market Conduct Rulebook, or Directives related to Market Offences can attract one or more of the following penalties (per violation):

- disgorgement of the profits gained or losses avoided;

- up to AED 20,000,000 for any individual;

- 300% of the profits gained or losses avoided (if greater than the above values).

Violation of the rules in all other Rulebooks can attract one or more of the following penalties (per violation):

- up to AED 8,000,000 for an individual;

- up to AED 20,000,000 or 5% annual revenue for a VASP; or

- 200% of the profits gained or losses avoided (if greater than the above values).

Anti-Money Laundering / Combating the Financing of Terrorism related offences will be subject to the penalties imposed under the applicable local and federal laws.

Violation of Marketing Guidelines

All market participants, whether licensed by VARA or not, must adhere to the Marketing, Advertising and Promotions regulations. VASPs, businesses offering non-Virtual Asset activities and individuals should be aware of the penalties for non-compliance.

- Failure to ensure that any marketing, promotion or advertising meets the requirements of paragraph II.1 and/or II.5 of the Marketing Regulation (whether directly undertaken or facilitated as a service provider) and/or failure to notify immediately VARA of any non-compliance post occurrence will merit AED 200,000 fine.

- Failure to comply with paragraph II.2 of the Marketing Regulation regarding paid content or carrying out Marketing relating to VA or VA Activities on any form of media platform after a request from VARA not to do so will merit AED 150,000 fine.

- Failure to comply with paragraph II.7 of the Marketing Regulation by entities not licensed by VARA but targeting residents and/or customers within the Emirate in relation to VA activities will merit AED 150,000 fine.

- Failure to comply with paragraph II.4 of the Marketing Regulation regarding issuance of any forms of VA without VARA approval and/or license will merit AED 100,000 fine.

- Failure to clearly communicate to the public the non-compliance with the Marketing Regulation as reasons for any suspension or cancellation penalties will merit AED 100,000 fine.

- Failure to maintain the necessary records in compliance with paragraph II.3 of the Marketing Regulation will merit AED 50,000 fine. Any other failure to comply with the Marketing Regulation will merit AED 50,000 fine.

Repeat Violation: If an Entity repeats the same violation within one year from the date of the previous violation, the amount of the fine in the table will be doubled, provided that a fine does not exceed five hundred thousand Dirhams [AED 500,000] per offence.

VARA Milestones

February 28, 2022 – Issuance of Law No. (4) of 2022 in Dubai and founding of VARA.

May 3, 2022 – VARA announced MetavHQ hub, a metaverse built on the Ethereum blockchain making VARA the world’s first regulator to make its metaverse debut.

January 2023 – VARA names its first CEO Henson Orser, the former CEO of virtual asset firm Komainu.

February 7, 2023 – VARA issued its Virtual Assets and Related Activities Regulations 2023.

Dubai and the Future of Virtual Assets

With these regulations in place, Dubai solidifies its position at the forefront of the virtual asset industry as the world slowly embraces the technology as part of their daily lives. As the dynamics and understanding around virtual assets continue to evolve, Dubai will certainly keep a watchful eye to keep up with the evolution and ensure the security of its investors, citizens, and residents in the digital world.